After Tax 401k Contribution Limit 2024 – Some 401(k) plans allow for after-tax contributions. What this means is that as long as you haven’t reached the maximum combined limit of your plan — which is $66,000 in 2023 — you can make after-tax . One of the biggest advantages of investing in a 401(k) or other employer-sponsored retirement account is that the money you contribute is tax deferred, which reduces the amount of your income that is .

After Tax 401k Contribution Limit 2024

Source : theneighborhoodfinanceguy.com401k Contribution Limits For 2024

Source : thecollegeinvestor.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comContribution Limits Increase for Tax Year 2024 For Traditional

Source : directedira.com2024 Contribution Limits Announced by the IRS

Source : www.advantaira.comRoth IRA: Benefits, Rules, and Contribution Limits 2024

Source : districtcapitalmanagement.com401(k) contribution limits 2023 and 2024 | Fidelity

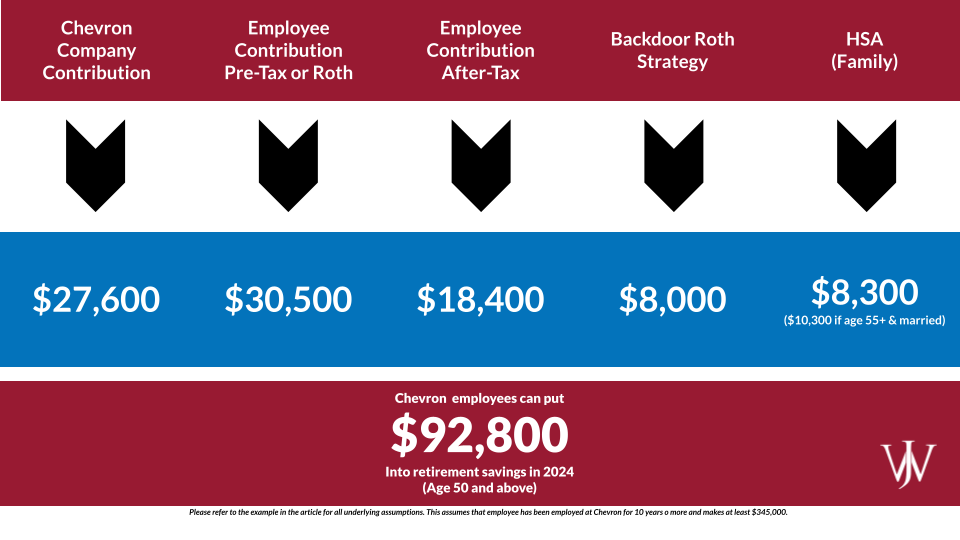

Source : www.fidelity.com401(k) Contribution Limits & How to Max Out the Chevron Employee

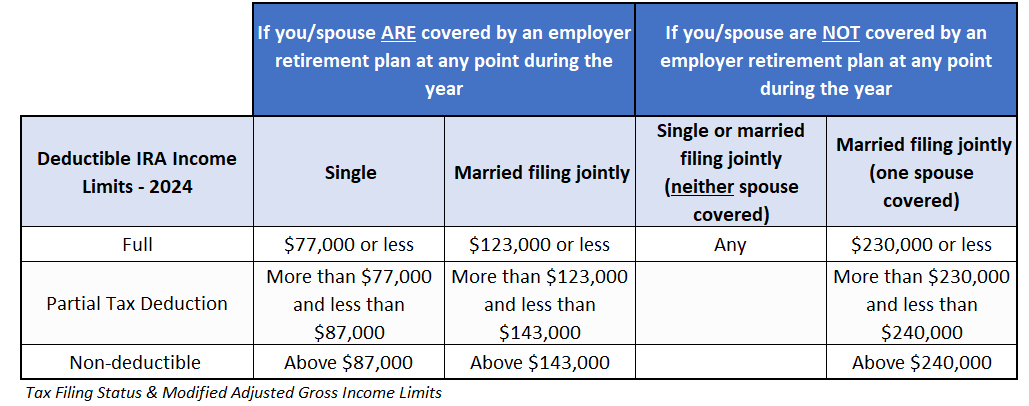

Source : insights.wjohnsonassociates.com2024 IRA Tax Deduction Income Limits | Darrow Wealth Management

Source : darrowwealthmanagement.comThe Ultimate Roth 401(k) Guide 2024

Source : districtcapitalmanagement.comAfter Tax 401k Contribution Limit 2024 Here’s the Latest 401k, IRA and Other Contribution Limits for 2024: People get confused thinking that 401(k after you stop working. Now, you’re probably wondering, what is the maximum amount you can contribute to your retirement plan—and thus save in taxes? . That means a full $30,000 this year, and more if you’re 50 or older: The 401 (k) maximum for 2024 is $23,000 and the IRA maximum is $7,000, and savers who are 50 or older can make additional .

]]>